| Author | Message | ||

Sifo |

We pulled a big chunk out with the DOW around 28,000. It was to buy the new house, so timing was, like Court's, pure luck. We are scheduled to close the sale of the old house April 1st. We'll see how the reinvestment goes. | ||

H0gwash |

I have some tiny ROTH IRA which I put $1K into decades ago and I watch it go up and down. | ||

Ratbuell |

I'd say getting out of the market at the moment, doesn't require anything "insider"...just prudence, if you can afford it. My 401k is so far from being usable for me, it's simply sitting and riding it out. When things look like they're bottomed, I'm going to call my brokerage and tell them to "buy the big boys now while they're low". | ||

Court |

Smart move. My personal… Nearly worthless… Opinion is that absent any underlying fundamental change in the businesses that make up the Dow… That staying in the market is the strategy I would follow. Be mindful… They are not actual “lost” and less you bail… | ||

Pwnzor |

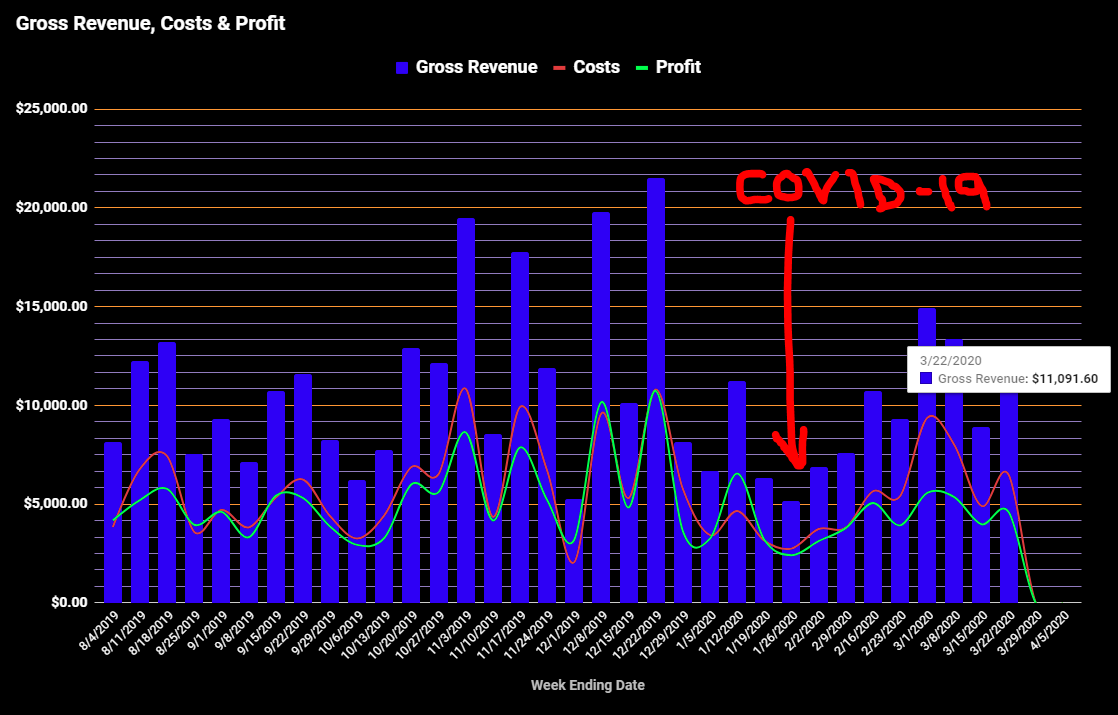

This is a normally slow period for me... but take a look at this. The graph below reflects the income for only two trucks in my fleet. They're my White Glove / Gold Team service units, which I use for technology deployments and asset recoveries.  | ||

Sifo |

I understand that trucking is doing well at the moment, trying to resupply stores where people are stocking up/panic buying (I'll let you decide). I think that eventually, that is likely to go to normal, or a bit below normal levels as people use their stock piles. Then overlay what ever hit we have on the overall economy. If this is a multi-year thing, it might be very bad. If there's a quick cure, maybe it won't be so bad. Long term, we will adjust. | ||

Pwnzor |

| ||

Sifo |

So we topped 250,000 known infections this AM. That's double of 3 to 4 days ago. At that rate, we would double twice in the next week. Should be interesting to see if we hit a million known infections by next Friday. Then 4 million on the Friday after that. The scary thing, is that with a 14 day incubation period, most of those 4 million are already infected. I would be thrilled to be very, very wrong about that projection. | ||

Tpehak |

3D Printed Ventilation Valves for Coronavirus | ||

Pwnzor |

I understand that trucking is doing well at the moment, trying to resupply stores The graph has nothing to do with regular freight. It's new equipment getting installed in laboratories and classrooms, and old equipment being recovered for refurb or recycle. Overall, our revenue is up: November $31,345 per day December $29,712 per day January $29,947 per day February $30,884 per day March $32,315 per day thus far This is everything from small package courier to full truckloads. | ||

Hootowl |

I wonder - how many of those are new infections vs. new diagnoses? Unless you test the entire population daily, you cannot know the number of new infections. You can know how many people present themselves for treatment, and how many new positive tests results there are, but that is not a complete picture. In fact, it’s a rather deceptive one. | ||

Hootowl |

Hey, who would have thought that we could save the world by sitting in front of the tv eating cheetos all day for a month or two? | ||

86129squids |

| ||

Aesquire |

https://wattsupwiththat.com/2020/03/16/diamond-pri ncess-mysteries/ Cruise ship numbers. Court is correct, I "made" a lot of potential money in my Thrift Savings account, over the winter, and "lost" the year's gains this month. But not really. The stuff I'm invested in changed price, ( basically the stock market. I "own" shares in a list of stocks ) but until I cash in I still own the same number of shares. If I take money today, it will take more shares than in Jan. & I "lose" money, but only relative to Jan. 2020, I'd "gain" relative to the entire 8 years of the Barry ruination. The big mistake amateurs make is to panic sell when prices fall. If you have a 401k that you are still paying into, still working, and aren't able to pull money out without hurting yourself with taxes, then you actually WANT the market to be low, as that will pay more, later. You're buying low. All gains and losses are imaginary until you cash in some chips. And this isn't a real casino, the chips aren't a money number, they are variable price stocks and bonds. ( and maybe gold, or other variables ) People freaking because their 401k is down, and "they should have sold a month ago" might as well agonize over not buying stock in Alphabet when it opened, or failing to kill Hitler before he took power, or making the unfortunate career choice in High School. It's just self abuse. Look forward. | ||

Hootowl |

Yup. Now’s your chance to buy that hot stock you missed out on. This too shall pass. | ||

Sifo |

I wonder - how many of those are new infections vs. new diagnoses? Unless you test the entire population daily, you cannot know the number of new infections. You can know how many people present themselves for treatment, and how many new positive tests results there are, but that is not a complete picture. In fact, it’s a rather deceptive one. But it's the view of the world that epidemiologists deal with all the time. You have to do the best you can with the data you can get. What you are really getting is how many people were infected x days ago, where x is the incubation period. I believe x for this virus is in the 10 - 14 day range. With a doubling of cases every 3-4 days, and our data being 10-14 days old, how many are likely already infected? Do the math! I see Michigan has added 225 cases today for a total of 549. Do the math! | ||

Aesquire |

https://ricochet.com/733124/america-comes-together -keeps-its-distance/ Humor. The following is not sarcasm, however. Somewhere across the Atlantic, there's an African nation that signed up to China's One Belt One Road program, where the idiots in charge borrow more money than they can ever pay back, ( because they are corrupt and will steal it ) use more of it than usual to build roads and infrastructure, ( because the Chinese are exerting more control than morons in The West do when they give money to corrupt regimes, so they won't steal as much ) and imported thousands of Chinese workers to build the projects. The End Game on One Belt One Road will come when the improvement doesn't generate the economic growth sufficient to pay back the loans, ( because, corruption ) and the Chinese government will take over. ( They are not idiots, and know that the locals are corrupt, and figure taking over is easier with incompetent enemies and a grateful population ) Anywho... One or more of those African countries has, like Italy, thousands of Chinese workers that went home for New Year's, and brought Pooh's Breath back with them. But officially, there are Zero cases admitted to, ( because that would make Xi look bad ) and will "suddenly" show incredible rates of infection when the silence is broken by waves of refugees or posts of mass graves leaking out of censorship . Ditto, as more people get tested here, there will be a "sudden, worrying rise!" in cases, that isn't sudden at all. It's simply a matter of math & current ignorance. | ||

Sifo |

Funny and informative! | ||

Thumper74 |

Aesquire, I'm 36 and my 401k has lost 15% in less than two weeks. I have my funds set up equally in three areas: low, medium and high growth. I'm kicking around moving it all to high growth, which is also high risk. Would this be a terrible idea? Keeping in mind my post about the PEF acquisition a few weeks ago... | ||

Ratbuell |

Wait till it bottoms out. Once it hits the floor...it will only go up. That's when I'm calling my brokerage, and telling them to get aggressive. | ||

Macbuell |

I rebalanced to money market and treasury funds a couple weeks ago and moved back in the market this week. Probably a little too early but I got sick of stressing on it and figured I had bigger things to worry about taking care of the wife and kid. I lowered my break even point considerably. | ||

Sifo |

Aesquire, I'm 36 and my 401k has lost 15% in less than two weeks. I have my funds set up equally in three areas: low, medium and high growth. I'm kicking around moving it all to high growth, which is also high risk. Would this be a terrible idea? Keeping in mind my post about the PEF acquisition a few weeks ago... If you don't mind me chiming in... Based on your age, go as high risk that your 401K has that will allow you to sleep a night. You have a long way to go before you can take it out. The market will rebound. "High Risk" in a 401K isn't what more seasoned investors would consider high risk. It's going to be well balanced mutual funds, unless you have some unusual options. Of course, you think you may need some as a hardship case if you get laid off, plan a reasonable amount accordingly. Again, make sure you can sleep at night with your decision. I've known people who just can't relax with their money exposed to the market forces. | ||

Sifo |

Automakers Might Retool To Make Ventilators When I see stories like this, I can't help but wonder... Just how many ventilators do they think they may need? This is the kind of thing we haven't seen since WWII. | ||

Aesquire |

kicking around moving it all to high growth, which is also high risk. Would this be a terrible idea? I haven't a clue. All the experts say to have a balance of investment so you don't lose everything. Stocks go down = bonds go up, so you want some of both. That's conservative, not maximizing. But if it's retirement savings, you try & conserve or at least not gamble recklessly. Another thing I've learned is fund managers, people who change the items in the fund, usually do worse than an index fund that simply buys everything and rides the market without trying to beat it. There are thousands of losers to every winner when you play the market as a gamble, just like any casino. That's true of professional fund managers and day traders. A very few do really well, and everyone else does less than average. Thus I do have some bonds and treasuries, but mostly it's in index funds. I might have made a different choice if I wasn't in a government run plan, but I can't pick a winning manager, and am limited in making changes to periodic open seasons. I spent a decade fiddling with it, then just let it ride. ( not really enough time to perfect a plan, but... ) Another thing I've learned is never sell because of crisis. There's exception for, say, selling off stuff that's going to become obsolete. The internet killed fax machine sales, for example. But foresight is rare. But you SHOULD buy because of crisis. Medical equipment makers in the U.S., for example. If you dumped them when Obamacare crashed their business with extra taxes, ( simplification ) you'd be kicking yourself today. But if you buy today, the odds are good that long term you win. Or at least not lose. Disclaimer! Past performance, blah, blah, CYA!, blah blah, do your own research, yadda yadda... And my advice on buying stocks is Not supported by me being fabulously wealthy, or I'd be rich. And I am not. | ||

Hootowl |

I trust my fund manager to deal with all that stuff. That might be foolish, but they will do a better job than I have the experience, capability, and interest to do. | ||

Ourdee |

Re-tooling heavy on robots and tax write offs. Not to mention Uncle Sam as the customer could net healthy profit. They have people costing them money not doing anything. | ||

Sifo |

Yep, another video. Watch it... Or don't. | ||

Sifo |

Hey! Somebody gets the math on this! NIH director: Up to 70K coronavirus cases could be confirmed in US by end of next week | ||

Sifo |

And a lighter side video from Les Stroud, AKA Survivorman...  | ||

Court |

70k?......California Gov. predicted 25,000,000+.... https://www.abc.net.au/news/2020-03-20/los-angeles -locked-down-amid-expected-coronavirus-surge/12074 886 Hunkered down and staying |