| Author | Message | ||

Sifo |

From the no sh*t Sherlock files!

More... Time to stop blaming Bush and admit that BO hasn't got a clue how the economy works. Now we are $15 trillion in debt. Vote the bum out!  | ||

Carbonsteel |

I used to think there was no way the nation would survive another 4 years of Obama. Now I not sure we'll survive the first. Between Bush and Obama....we are so screwed. | ||

Cityxslicker |

and you should try and get some real numbers from them on the ACA Health Care bill..... There is a reason they dropped the Long Term Care OUT of the bill - auditing independent accountants couldnt make the numbers, and projections work using standard insurance actuarials...... that ONE component was used to make this thing 'budget' neutral and key to the 'savings' in the reforms implementations..... and the rest of the bill fails similarily. It is however a nice pump and dump for the tech industries that are supplying the widgets to its requirements..... and those companies are like a who is who in contributions to Obama's campaign contributions...... (their stocks are performing well - for now - their bubble is about 2015-6 : right when the new currency comes out) | ||

Buellkowski |

From your link, Sifo... "All told, the stimulus did boost jobs and the economy in the short run, according to CBO’s models. At the peak of spending from July through September 2010 it sustained anywhere from 700,000 to 3.6 million, which lowered the unemployment rate by between four-tenths of a percent to 2 percent." "For this current quarter CBO said the stimulus is sustaining between 600,000 and 1.8 million jobs, which has improved the unemployment rate by as much as 1 percent versus what it otherwise would have been." 0.2% higher growth after 2016 or 1 million more unemployed now. You decide. | ||

Sifo |

Buellkowski, Here's the last line of the article...

So the exact thing that is causing the long term negative effect isn't factored into the short term effect. That's one of the problems with CBO estimates. They are governed by strange rules that more often than not don't reflect reality. (Message edited by SIFO on November 22, 2011) | ||

Aesquire |

Actually Buellkowski has a point, but Doesn't realize it. This admin has hired over 1 million people. If we went back to the 2007 budget, we would have to lay off that million and leave us with the long term costs of health care and retirement. ( not sure how much, since the million people have only worked for less than 3 years. ) To put it another way. That million people making good, living wages, ( better than average ) take the taxes of how many millions to pay for? 8? 12? 15? So looked at pessimistically, that's 12 million people whose taxes do not go to pay for anything the government is actually supposed to do. Or 12 million people whose taxes are lost to build roads, pay teachers, or pay for the environmental impact statement that would prevent us from EVER building another Hoover Dam.  | ||

Buellkowski |

Keep in mind that $288 billion of the Recovery Act (37%) was tax cuts. | ||

Court |

>>>better than average About 31% better with many in the >$160,000 range. Unfortunately these are government employees were are the sole reason you could NOT build the Hoover Dam today. | ||

Sifo |

Keep in mind that $288 billion of the Recovery Act (37%) was tax cuts. Are you really asserting that the economy would be better if we had taken an additional $288 billion out of the economy? | ||

Court |

also be mindful that the can't find where about $200,000,000 of it went to. http://www.entrepreneur.com/blog/218928 | ||

Cityxslicker |

ant habitat studies and squirrel ramps. | ||

Buellkowski |

I'm asserting that $288 B didn't come out of the economy, to the administration's credit. Are you asserting that there should have been no Recovery Act? Consider how much of a drag on our economy an extra 1 million on the unemployment dole would have been. Court, your link seems to refer to unspent stimulus funds, not "missing" funds. Kind of funny that the author is critical of the slow pace of funds disbursement, not that the stimulus shouldn't have been approved. Are you also of the opinion that there shouldn't have been a Recovery Act? | ||

Sifo |

Are you asserting that there should have been no Recovery Act? That would have been better than a program that has a negative impact. Consider how much of a drag on our economy an extra 1 million on the unemployment dole would have been. The CBO seems to think the extra unemployed would have been less of a drag than the recovery act; Hence, "net drag". Is it better to shoot nothing or shoot yourself in the foot? | ||

Buellkowski |

The CBO seems to think the extra unemployed would have been less of a drag than the recovery act. I didn't take that away from the report. What I read was a measurement of short-term vs. long-term effects. The program had a positive impact on employment (now) in exchange for a slight negative impact on long-term growth (in the 4-year-forward crystal ball). I think employed people spend more money than unemployed ones, in general. | ||

Ft_bstrd |

I think employed people spend more money than unemployed ones, in general. The problem with that position is that most of the increases have come in government jobs and wages. 100% of those wages are paid through taxes. It's like cutting a sandwich in half and giving a piece to two people and saying that there is twice as much sandwich. | ||

Sifo |

The CBO seems to think the extra unemployed would have been less of a drag than the recovery act. I didn't take that away from the report. What I read was a measurement of short-term vs. long-term effects. That's because you ignore the last line of the report where they say that they haven't factored in the crowding out of private investment in the short term. Even so, what about the long term? We have a very slight gain in the short term (based on incomplete analysis that ignores obvious negative factors), but in the long term it's a negative. That's shortsighted at best. Is this really something that you want to defend? That heroin sure feels great in the short term! Too bad it kills you though! | ||

Buellkowski |

The problem with that position is that most of the increases have come in government jobs and wages. Can you show us where in the CBO report, or in the terms of the Recovery Act, it supports your position that "most" of the employment sustainment due to the Act has been in gov't jobs? Do not count gov't stimulus contracts fulfilled by private employers. Sifo, I understand your comment about short-term crowding, but do we know why the CBO report didn't calculate the short-term crowding effect? Should we assume it's substantial, even if there's no evidence of that given in the report? | ||

Sifo |

Should we assume it's substantial, even if there's no evidence of that given in the report? No. We should assume it wasn't accounted for as stated. The CBO is little more than a calculator that takes the information provided (by the administration) and performs the calculations. It's a pretty flawed process that tends to give the best case scenario of what is being scored simply because the provided assumptions are typically extremely rosy. That's one of the reasons that virtually every government program winds up costing many times more that expected. That's no slam against BO, it's just a product of our government. Can you show us where in the CBO report, or in the terms of the Recovery Act, it supports your position that "most" of the employment sustainment due to the Act has been in gov't jobs? It's been well documented that the growth in employment has been virtually all government employment. It seems fair to examine what we know to be true beyond just what was in the report, though I bet it's in there if you want to go through the report details. Do not count gov't stimulus contracts fulfilled by private employers. Why not count them? Those are still jobs that are totally dependent on tax payer dollars, i.e. a drag on the economy. | ||

Buellkowski |

Interest rates are very low, and interest rates are an indicator of the scarcity of capital available for investment. Does it seem to you that borrowers are competing with the gov't for loans right now? It doesn't seem that way to me. Those are still jobs that are totally dependent on tax payer dollars, i.e. a drag on the economy. Perhaps the automatic budget cuts due to take effect will pare back some of the dead weight? | ||

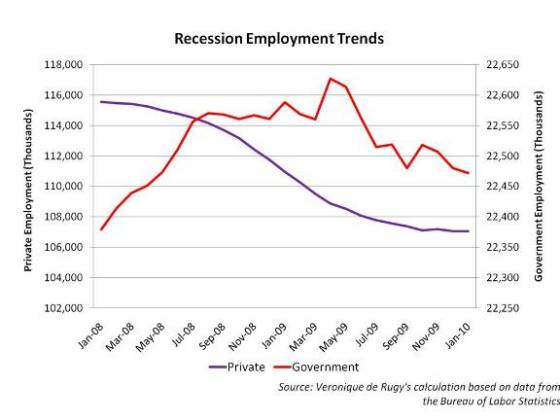

Ft_bstrd |

It doesn't matter if the jobs are performed by public employees or private contractors. 100% of the WAGES come from TAXES.    Shall I post more? Government has sucked all the money that would have fueled the recovery and created more bureaucracies. | ||

Cityxslicker |

wait until the hospitals are 'nationalized' ... yes, it is so much better / sarcasm. | ||

Sifo |

Interest rates are very low, and interest rates are an indicator of the scarcity of capital available for investment. Does it seem to you that borrowers are competing with the gov't for loans right now? It doesn't seem that way to me. Yes interest rates are low. There's numerous things that go into that. It's anything but an indicator of scarcity of capital though. If cash was scarce it would tend to drive rates up. Right now cash is on sale and few are willing to take the low rates and risk the capital with expansion. What do you mean by borrowers competing with the government for loans? Since when does that happen? Those are very different things. You just keep digging yourself into a deeper hole with every post you make. | ||

Buellkowski |

FB, thanks for posting, but I still don't see anything that shows us your contention that most of the jobs sustained by the Recovery Act were government jobs. In fact, your second chart seems to allude that the stimulus staunched a tide of job losses in the private sector. Your third and fourth charts, with their two y-axes, are somewhat disingenuous comparisons, IMO. Eyes are drawn to the colored lines rather than to the values those lines represent. Remember when I posted in another discussion what the top three categories the overwhelming majority of "government jobs" represented? Defense, education, and law enforcement. Are these three categories the ones that you expect to pare back in times of economic recession? If not, then why disparage their maintenance at current levels? The Recovery Act contained $100 billion for education, almost none of which is for hiring more teachers, from what I can see. | ||

Buellkowski |

What do you mean by borrowers competing with the government for loans? Since when does that happen? You were making assertions about short-term crowding of the capital markets due to the stimulus package, weren't you? How do you define such crowding then, since you appear to define it differently than I do. | ||

Court |

Education spending has doubled in the last 10 years. Hooray Test scores have plummeted. Oops How's that throwing tax dollars at a problem working out for you? | ||

Sifo |

You were making assertions about short-term crowding of the capital markets due to the stimulus package, weren't you? How do you define such crowding then, since you appear to define it differently than I do. It's straight from the part of the article I quoted in the original post.

| ||

Sifo |

Education spending has doubled in the last 10 years. Hooray Test scores have plummeted. Oops How's that throwing tax dollars at a problem working out for you? Clearly we haven't thrown enough money at the problem. We need to double down!  | ||

Buellkowski |

The scores in my son's public elementary school have improved.  And I'd be willing to bet they're not spending twice as much (adjusted for inflation) as they did 10 years ago. Professor Canfield, with all due respect, your causality argument is quite weak, even to my woefully uneducated mind. | ||

Sifo |

Professor Canfield, with all due respect, your causality argument is quite weak, even to my woefully uneducated mind. I don't see where causality was claimed. He simply pointed out the increase in spending with a simultaneous drop in test scores. What is clear is that increasing spending hasn't improved education. From there we can discuss potential causes. Cash clearly seems not to be the cure though. | ||

Court |

http://www2.ed.gov/about/overview/budget/history/e dhistory.pdf Frankly........if you wanted to fiddle with some measures of correlation you could "prove" that more spending results in dumber students. It was interesting to listen to the logic of the big o as he tried to defend public schools while fighting o keep his daughters out of one. It's a •••••• up system. Doesn't mean it doesn't work ...... It means it works poorly and inefficiently. |