| Author | Message | ||

Wolfridgerider |

My 401K is "almost" back to what it was before the bottom fell out. Being that my financial advisor didn't advise me in any way shape or form that I may want to circle the wagons.... what is a good indicator that its about to hit the fan again? | ||

Blake |

I've been thinking the same thing. Interesting to note that if a portfolio drops by 40%, it needs to realize a net gain of 67% just to get back to where it was. | ||

Court |

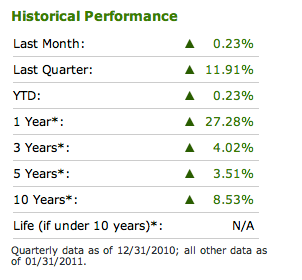

This is one reason why a few folks are going to be hesitant to buy pricey items and why there is so darn much money sitting "on the sideline". My wife, much keener than I on these matters, moved my entire portfolio to a bond fund about 60 days before the market tanked. She'd quit her job as CFO of a Hedge Fund and spent the next two years, during the most turbulent of times, trading her own account. About 4 months ago she moved me "back onto the field" and . . as is the point of this thread. . . . now is the time to play serious for those of us thinking of retiring the next 10 years. My personal example was that I had kind of a pricey car ordered (at least had a build slot) and she sat me down one night and "did the math" between driving a paid for "beater pickup" (no kidding, she was mean enough to say that) and the very pretty new car. It didn't take much math to see that if I took the sum for the new car . . . placed it in an account and played my cards right . . hell, the car would pay my comfy living expenses from the day I retired until the day I die. I also, the day my Granddaughter was born, opened a trading account for her and did something I have always wanted to do . . . simply invest a fix sum, every day . . . by the time she turns 18 I'll be long gone but I'll bet she appreciates it. This is what my I.B.E.W. Union account looks like as of 10:00am this morning. Frankly, if what I think is going to happen actually takes place the next 24 months . . there will be a lot of folks making less than 50K who make a boat load of money. . . . it's time to play smart, not brave.  | ||

Stirz007 |

I was 75/25 stocks/bonds right up until the talking heads started saying "Don't worry. Keep your stock investments, blah blah blah...." That's when I knew the manure was hitting the ventilator. Changed to 75/25 bonds/stocks next day (Octoberish), and still took a $35K hit. But compared so those who listened to the pundits, I came out much better (at least I think I did) - It's all virtual money anyway. Bonds have been fairly consistent over the last few years at 6-8%. | ||

Kyrocket |

I'm with you Wolf, mine is almost back to where it was when I gave it to them seven years ago. | ||

Wolfridgerider |

He Court... could you ask your wife to let us "not so money smart" folks know when it may be a good idea to pull back. | ||

Court |

I don't have the guts for that business. Her specialty has been complex international transactions . . . . like where you take $3B at noon and bet the Indian currency against the Yen or something . . . it sure gives you an appreciation for how much money can be made or lost when you are leveraging that sort of money and the frickin' market moves $0.01 I prefer electrical power lines where I can only fall or get electrocuted!  | ||

Wolfridgerider |

If we are talk'n about what we would prefer... Trust Fund comes to mind. But I know that's not gonna happen.  | ||

Court |

>>>Trust Fund comes to mind. Highly overrated. One of my best friends' family owned, for years, the majority shares in Firestone Tire Company. It looked fun when she was flying her Arabian horses legend the world playing "I wanna be an equestrian legend" but I saw the whole deal cave in personally. Stick with what you've got . . . you're a lucky guy! | ||

Whitetrashxb |

wow, if i'm seeing that right, those are some fantastic return rates... | ||

Court |

There are some amazing things happening right now . . . the economy still, in the big picture, sucks. But . . . there is some mental momentum that's going to carry through a bit. You may recall, if you go back and look in the archives, I said late 1st quarter 2011 . . . . it was pure luck but it's playing out. I'm playing . . .but very cautiously . . . I treat it much differently than I did at 30 years old. I can't be stupid but I can't ignore the power of compound interest and dividend income. | ||

Wolfridgerider |

"I wanna be an equestrian legend" Hell, I just wanna be solvent.... Or a "Buell riding legend" that would work too.  | ||

Court |

From today's Wall Street Journal . . . .

By the way . . . . I also laughed at what happens to the word "February". | ||

J2blue |

I'm investing in plywood and foil/bubble/foil for my retirement. I've picked out a nice piece of real estate under an overpass that should be just right. If I reload my own ammunition I should be able to retire comfortably by age 77. | ||

F22raptor |

It is just #s on a piece of paper..They are living off of your money...There were no losses in the crash,just adjustments.If you think some 27 yr old kid "Earned" 5 million,you are nuts,he just got a chance to dip into your well! | ||

Court |

>>>>It is just #s on a piece of paper. You make me feel like crap for cashing that dividend check last week. I also expect to be hearing from the University of Kansas after paying for 2 kids for 6 year with checks from sold MSFT shares. Thanks for the advise.  | ||

Wolfridgerider |

It is just #s on a piece of paper. I like those numbers.... the bigger the better. I've been putting money into it for the last 13 + years... its my retirement... they are not just numbers to me | ||

Sayitaintso |

The other side of the coin is debt. Not only is there not enough saving for retirement, many folks are carrying a bunch of debt into retirement; first mortgage, second mortgage, car payments, and so on. Its going to be UGLY for many people that didn't think any further down the road than their next paycheck. Add the fact that "entitlements" from the feds are not going to be what many people think and lots of folks are going to be working for most if not all of their life. Not that it is a bad thing, "retirement" takes; making plans (and sticking to them), sacrifices along the way, and a little luck. | ||

Xl1200r |

I've been putting money into it for the last 13 + years... its my retirement... they are not just numbers to me Wolf, I think the point of the comment was more that they're only numbers UNTIL you cash out. You haven't lost a dime until you pull out. Same goes for gains. That said, I really feel for everyone who is (or feels) close to retirement age and don't have a ton of faith in their savings. If you're super upset that you've lost your ass over the last decade in your 401(k), you probably were being too risky with your accounts given your age. If you're not close to retirement age, then you've got time, don't worry. I look at it this way: When the market tanks, it means I can buy cheap and realise bigger gains in the future than if I had bought when things were all up. But, then again, I'm young and only started investing in the last couple of years and I likely have another 40+ years of work ahead of me. For the record, I started investing in 2008 and haven't been in the red at year end yet. Also, if your company does any kind of matching, maximize that. My work used to do a flat 4% contribution if you kicked at least 3% of your gross - Yes, they'd put it more than I was. They changed it to a sliding scale, where your 3% only got you 3% from them, and you had to kick in 5% to get the full 4% from them. So I bumped up my contributions that day. I should be doing more and as soon as my debt issues are all fixed (nothing major) I'll bump it up again. I also own my own home, which is pretty good for my age and I hope that provides some financial gain down the road. I bought at the bottom of the market and have already gained over $20k in value (estimated, of course). | ||

Sayitaintso |

Good for you Mark. If you are looking at the long range and not in something that needs to be actively managed (something like an indexed mutual fund) then my advice is dont look at it too often. The daily/weekly fluctuations will drive you nuts. Especially when it gets built up a bit, $5,000-10,000 swings one way or the other on a daily/weekly basis seem to get my blood boiling even though like you and Brian said...... its only numbers until you cash out. I've got another 10-15 years to "let it ride" before diversifying more. I try to force myself to only look at the 401k only once a month or so. The other stuff I have put away is checked at least daily b/c it is directly in equities and can crash and burn while the overall market is unchanged. | ||

Blake |

I have two friends who by sheer luck due to change in employment, had their entire 401K moved into a simple interest bearing account just before the big crash. They avoided having to take a 30% to 40% hit. Then they got back into the market via index funds and realized the ensuing 60% gains. That pretty much describes the term "good fortune"! LOL. I'm a coward when it comes to investing. Was very tempted to put a bunch into Ford when it hit $1.28 or whatever the low was. If only. I also recall scoffing at the google IPO of $50. Idiot. So is the market good to go or fixin' to adjust? | ||

Blake |

>>> If you are looking at the long range and not in something that needs to be actively managed (something like an indexed mutual fund) then my advice is dont look at it too often I used to think that too, but the past ten years kinds shows the risk in that. As mentioned above, it takes a gain of 100% to just get back to where you were before enduring a decline of 50%. | ||

Blake |

| ||

Daves |

I get to work until I die. Good thing I love my work! | ||

Sayitaintso |

Blake its only a 50% loss if you bought everything at the top and sold or have counted your gains before you've realized them. Otherwise the loss is only giving back unrealized gains. Thats why I said long term, over a 30-40 career a downturn for 2-3 years will be made up.... plus some. Some "shares" will bought at the top and you'll lose, others will be bought at the bottom and will have huge gains. The important this is to be consistent and shift your position (to less volatile investments) as you get closer to needing to rely on the money and are not able to "ride-out" the downturns. Timing the market to cash out at the top and buy back in at the bottom is really hard to do.....even for pros who do it for a living. It would really suck to sell out at or near the bottom the buy back in after much of the rebound/recover has already happened. Unfortunately for many people, thats exactly what they do. Short term market volatility will drive you nuts if you follow it close and have a long term investment plan. If someone's not in a position to weather the storm of 2-3 year downturns they are in the wrong investment class, imo. Maybe a nice money market would suit their risk tolerance level better. Mutual funds are about the most unsexy equity investment there is. That said, what the hell do I know....I'm just an average schmuck trying to make a living like everyone else. | ||

Court |

>>>>.....even for pros who do it for a living. That's correct. Trying to "play" the market based on the daily news, at least for me, is an invite to "ratchet down" balances. I try, at this stage, to look at things once a month. I've made a bit of a move right now . . from time to time . . . I "run toward the cliff" . . stay a bit . . then retreat. Some of the new tools, most notably ETFs (Exchange Traded Funds) have offered folks access to investments that weren't possible in the past. For me . . and I claim to know nearly nothing . . the key is to max out my 401(K) and take full advantage of our stock purchase plan. For every 9 shares I buy, they give me 1 . . that, at least to me, is FREE money and anything I fall short, in terms of maxing that out . . is pissing money away. Funny . . how you see this stuff from differing perspectives at differing times of your career. Interesting discussion and I think one of the keys . . at least for me . . .that I've long lectured my kids about it debt. My oldest refuses to use ANY debt, rides a bike to school and borrows nothing. He just bought his first house in Portland and it scared him to nearly to death to sign a mortgage. . . . good.  Sounds like a lot of the younger folks here have a good handle on things. I've watched folks who make $400,000 retire broke and electricians retire with more than $2,000,000 in their account. Planning | ||

Sayitaintso |

I couldn't agree more....interest on debt for the average joe (like most, if not all, of us here) is the closest thing to financial evil I know of. Many folks save and earn, say 5% on their savings. They turn around and borrow for a car/bike/TV (or whatever) and pay 12%. They are losing 7% on every dollar they save rather than paying down/off the debt. Edit: Court, with the stock plan from work......dont forget to rebalance periodically, remember the poor folks at Enron? But then you already know that, I guess my comment is more directed at other that may be reading this and have company stock plans. Don't let all your eggs end up in one basket. (Message edited by sayitaintso on February 22, 2011) | ||

Xl1200r |

Anywhere you look will tell you that the best results will be had from dollar cost averaging, the key is match funds/methods that macth your risk tolerance. I just got my annual 401(k) performance letter in the mail with all kinds of (mostly) useless charts and graphs. It showed that if nothing changed, but the time I reached retirement age I'd have $1 million assuming an average 5% annual rate of return. Firstly, things will change - I'll make more money in future which means my and my employer's contributions will go up. My percentage will go up as well. Secondly, my rate of return last year was just shy of 20%. I'm a little over 7% so far this year and I may move some things around in a month or two to soome higher-gain accounts, we'll see. I try, at this stage, to look at things once a month. I try to do the same every month or two. And, like you, I'll dump some things into a higher risk area for a while and then pull them back. Never any very large changes, though. He just bought his first house in Portland and it scared him to nearly to death to sign a mortgage. . . . good. Agreed. Some debt is healthy and sometimes needed (I'd have never been able to pay for my education without it and the career payoff has been worth it thus far), but many folks are just in too deep (including myself at the moment, but just barely). I had the most unsettling feeling signing all those mortgage papers, and my house was realtively cheap! | ||

Xl1200r |

Many folks save and earn, say 5% on their savings. They turn around and borrow for a car/bike/TV (or whatever) and pay 12%. They are losing 7% on every dollar they save rather than paying down/off the debt. I think the more common error people make is paying off debt that doesn't need to be, like a car loan with 2% interest, instead of dumping that cash in a money market or CD account. | ||

Wolfridgerider |

I'm in decent shape. No bills other than the house and the usual operating costs. My wife and I are living on a 1/3 of what we made a few years ago so we both keep a eye on the $ We are both on the same page when it comes to taking on more debt.... its not gonna happen. If we don't have the cash, we don't get the _______ I've got 20 plus years to go before I will retire and I just want to limit the amount of mistakes I make between now and then. |