| Author | Message | ||

Stirz007 |

Assuming Fatty is right (and I tend to see it his way, although with a different slant), then what? To reverse almost 300 years of gradual erosion (or expansion, depending on your POV) of the original powers will take, at best, generations. You can't just go in and start closing departments or agencies - too many relatives and patronage jobs - there will be backlash to he who dares take away their sugar-teat. Same goes with programs, especially those that are de-facto entitlement programs - "I have a RIGHT to get my welfare". See how far that lead balloon with fly.. Americans (the voting or non/voting masses) don't have the patience or intestinal fortitude to see such a restoration through, I'm afraid. Absent insurrection or revolution (and good luck with that BTW), I do not see a "good" way to return to the core responsibilities of government. Good example. Carter (love him or hate him) took on the big water interests (U.S.B.O.R) and line-item vetoed a dozen or so large western water projects that didn't pencil out for the taxpayer, but benefitted BOR (by keeping Agency budget up) and large landowners (whose worthless land suddenly became very valuable with the addition of water paid for by someone else). It was probably the right thing to do for the American taxpayer, but it threatened the special interests. This incident was one of the reasons his party walked away from him come re-election time. Don't screw with the interests. Oh yeah, the projects all went through regardless of the wishes of the CIC. There are, and probably always will be, those who thrive at making their living off someone else, be it welfare, government contracts, working for the government, etc. History (and American history in particular) is full of cases of government fraud, feeding from the trough, etc. Nothing substantial ever seems to come of it. A few hands get slapped, maybe one or two guys do some easy time, whatever. The basic problem is us. There's a line in Shooter that I liked: Something like "Nothing ever happens without the knowledge of those in power. They just don't want to have to admit that they knew.." OUR elected officials made all this possible. (and by extension - WE made all this possible) It will take numerous election cycles at all levels of government just to halt the trend to socialism. It is basic human nature - everyone loves the idea of something for nothing - as long as someone else is paying for it. I'm thinking it would be great, but I personally am not holding my breath expecting things to go back to a simpler government - at least not in my lifetime. | ||

Sifo |

Gwb, OK you are for allowing people to make money, you just don't like them to accumulate wealth to pass to future generations. You still haven't explained how to determine when you start confiscation of wealth. This seems like an important aspect of what you believe. Have you not thought this through? Just trying to find out how you would make this determination. What about gifting it to the family before they die? Would you allow that? I hate to break this to you, but I think you are wrong that only a few families control the majority of our countries wealth. Also not all wealthy families are heavily involved in politics. You offer nothing to support any of your assertions and offer no details on what you claim should be done to solve the problems you claim to be true. This dialog between us is getting nowhere at a very slow pace, mostly because you are offering nothing to further the discussion. Why would I think term limits are un-American?  (Message edited by SIFO on August 10, 2010) | ||

Ft_bstrd |

i have never understood the idiocy of this train of thought. all people will suddenly stop wanting to get rich if they're taxed at a higher rate? Yeah, actually it does. In spite of what you may believe, the "rich" don't just pull crisp 100 bills out of their ass. It takes time, effort, and sacrifice to build wealth. If it didn't, everyone would be wealthy. Bill Gates doesn't just lounge around the pool picking up his paycheck. His schedule is probably more busy than you can possibly imagine. My wife and her partner started a children's clothing line 4 years ago. I have to help out and her partner's husband have to help out. There are times with that business that we are running 16 hour days to make it work. It's all hands on deck. If we knew that once built Uncle Sam would confiscate what we had slaved to create, we sure as hell wouldn't put that effort into it. At what point is building the business bigger not worth the effort? What if Bill Gates was constrained by the law that every dollar he earned or every dollar of value in Microsoft belonged to the Federal Government? What interest would Bill Gates have in working to create that next dollar? What would be in it for him? Would Apple bother creating the next iPhone if the wealth it created is going to be confiscated? Most liberals/socialists have a fundamental lack of understanding of what capital is and how economics work. Capital doesn't just manifest out of thin air. It comes as a result of work, effort, and ingenuity. | ||

Ft_bstrd |

These "rich undeserving offspring" are already only receiving half or less of the transferred family wealth. How much should they receive? What is fair? How much of the wealth created by the efforts of a parent over a lifetime should they have the right to determine who receives it? | ||

Swordsman |

"i have never understood the idiocy of this train of thought. all people will suddenly stop wanting to get rich if they're taxed at a higher rate? So, you're telling me that you'd really put your nose to the grindstone and double down knowing ahead of time that the pay increase was going to be minimal? You wouldn't just say, "Eh, good enough?" Go talk to (former) East Germany. ~SM | ||

Ft_bstrd |

"Doug, we'd like for you to work extra hours this Saturday. I hope you don't mind. Oh, and we can't pay you for those overtime, Saturday hours." Yeah, confiscation of wealth will have no bearing. None at all. | ||

Sifo |

i don't care who is in office the past two years, there would have been no change at all regarding using deficit spending trying to prewent the total collapse of the economy if john mccain were elected. (which he might have been if he didn't pick such a retard as his running mate.) the bailout process started even before the election, in september of 2008. Yes the bail outs were started by the previous administration, back when deficit spending was still being measured in billions of dollars. And he was ridiculed for it too. BO has taken it to a whole new level and they are still talking about another round of bailouts again. It's nothing but a huge slush fund that has zero accountability at this point. Do you actually support this? This is what is going to damage us for generations to come. Sorry, but predictions about what would have been true have no bearing in our timeline. If McLame had won the election then his policies would be on the examination table. BO won and he is the one spending our future away. and, sifo, you really need to brush up on your math. according to the stats you posted, not even the top 5% have kept up w/the rate of inflation. plug the salary rates into the year "1975" and see how much you would need to make to equal it in 2001. or 2008, or 2009... I hate to break it to you, but you introduced these figures into the thread. The earnings that you see are inflation adjusted already. They show that all income groups are doing better than inflation. I really hate when people bring data into a discussion to prove a point only to start refuting that same data when it works against them. And you have done a poor job at refuting the data to boot. | ||

Sifo |

...If you force folks with wealth to spend it or you confiscate it, you diminish the drive to build wealth in the first place. ..." i have never understood the idiocy of this train of thought. all people will suddenly stop wanting to get rich if they're taxed at a higher rate? doug s. You might just as well say that you just don't understand the basics of economics. | ||

Buellkowski |

Why isn't Germany in danger of capital flight, civil unrest, and imminent collapse? Their "socialist" tax agenda would make it seem ripe for the revolution some here would wish on ourselves. | ||

Gwb |

Capital doesn't just manifest out of thin air. It comes as a result of work, effort, and ingenuity. Yes, Ft_bstrd, and more power to 'em. And I believe there should be less power for those that don't. Ft_bstrd, if a generation or two downstream a descendant of Bill Gates buys himself a U.S. Congressional seat to work against the interests of your descendants, where's the "equal opportunity" in that? To his great credit, Bill Gates is trying to use his vast wealth to make the world a better place, and prevent that wealth (power) from being inherited. And what some here call "confiscation of wealth" others might call taxation, and vise-versa. The _amount_ of taxation is ALWAYS the argument, not if there _is_ taxation. We all bitch about it: "it's not fair", "it's socialism", "you're a communist" and so on. How it's implemented is: Elect politicians that agree with your point of view. Then argue and scream and yell and bitch and moan and compromise until you get a majority. Then do it. It's the American way. Or it's supposed to be: You know what a good politician is? Once he's bought he stays bought. (Mark Twain). | ||

Ft_bstrd |

There is a flight of capital. Do you know how many German companies own US companies? Far more than US companies own German companies. | ||

Ft_bstrd |

You're missing the point Gwb. You are attacking the wrong monster. Wealth (capital) isn't the problem. It's the attraction of those with wealth to government in order to increase power and wealth that is the issue. Return the Federal Government to the enumerated roles dictated by the Constitution. What interest does some trust fund baby have in working some low level government job? You do also know that even in the earliest Presidential position there was a father/son elected, right? Please list all the multi-generational political positions held by the same family for more than two generations. I bet you'll find far fewer than you believe. No where near enough to justify the wholesale confiscation of wealth. | ||

Sifo |

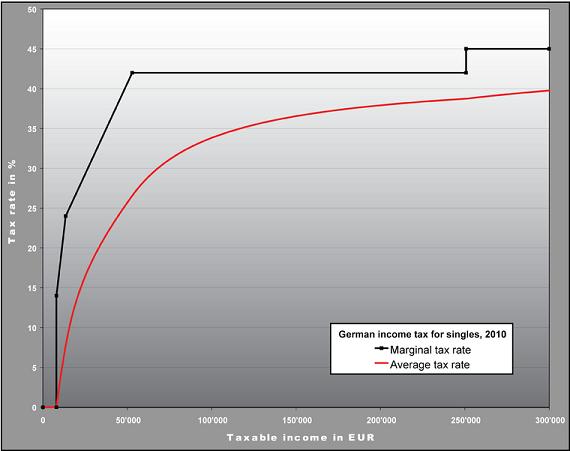

Buellowski, A bit of quick reading on the German tax system shows that in 2010 they lowered their personal tax rates. Top rate is now 45% from what I can gather, not the 50%+ you show as a mean. What's more from what I can gather is that reaching that 45% rate doesn't put you in that rate as your average tax rate. Only the income that puts you into the 45% rate is taxed at that rate. This winds up with an average tax rate of just under 40% for the "rich". It works like this...  Do you suppose the tax reduction in Germany came about because people were happy to be paying the amount of tax they were in your 2005 example. I have little doubt that there was tax flight of wealth and the government has reacted. | ||

Gwb |

You do also know that even in the earliest Presidential position there was a father/son elected, right? Yes, Ft_bstrd, I know. And do you know that only about a third of the citizens of our original thirteen colonies were in favor of separating from England? | ||

Strokizator |

i have never understood the idiocy of this train of thought. all people will suddenly stop wanting to get rich if they're taxed at a higher rate? $hit guy, just try to get someone to work overtime once they find out how much more the gov't takes out of their check. Talk about a disincentive to work harder. How much more proof do you need? And these are working class people, not "the rich". | ||

Sifo |

$hit guy, just try to get someone to work overtime once they find out how much more the gov't takes out of their check. Talk about a disincentive to work harder. How much more proof do you need? And these are working class people, not "the rich". Not only that when you work overtime it's guaranteed income. Most business folks do their work just on the hope that it pays off. I know too many business owners that wound up working 60+ hours per week for under minimum wage. The only guarantee in owning a business is that if you finally make it profitable, the IRS will be on your back. A friend of mine who owns a music shop just got a visit from an IRS agent claiming he still owes about $850 from something years ago. He told her to look around and take anything she thought would add up to $850. She said he shouldn't be in business if he can't come up with $850. He simply explained that if they push the $850 issue he won't be in business. The really sad thing about all of this is that years ago he was the largest G&L dealer in the country. Now all he has is guitar lessons for kids who's parents don't pay half the time. | ||

Buellkowski |

Sifo, I don't know why German taxes may have been cut, but I suppose the 2008 global meltdown may have had something to do with it. It appears to be a recent change, judging by the link associated with that Wikipedia chart. Their version of fiscal stimulus during the crisis? In any case, Germany is an industrious, prosperous country in spite of its 2005 tax rates. Why are we to believe that the USA is worse off with its relatively lower taxes? | ||

Sifo |

Why are we to believe that the USA is worse off with its relatively lower taxes? Compare our deficit spending to Germany. EDIT: And yes I did mention the tax change was done in 2010. It's recent. If they were doing so well why do you suppose the lowered the tax rate? (Message edited by SIFO on August 10, 2010) | ||

Gwb |

The only guarantee in owning a business is that if you finally make it profitable, the IRS will be on your back. "Government's view of the economy could be summed up in a few short phrases: If it moves, tax it. If it keeps moving, regulate it. And if it stops moving, subsidize it." Ronald Reagan | ||

Buellkowski |

Oh, I thought we were talking about the U.S. tax code that some believe robs & redistributes wealth unfairly, stifling growth and profit incentive. But I see we're moving on to spending now...  | ||

Sifo |

There is a connection between spending and taxes (there's supposed to be anyway). Right now we are spending our great grand children's taxes. I see that not only as bad, but immoral. If we could check the insane spending we could be better off than Germany. You did ask the question. | ||

Ezblast |

Geez - you are all way off topic! So - is HD moving out of Milwaukee? If so where? India or a non-union state? EZ | ||

Ft_bstrd |

Yes, Ft_bstrd, I know. And do you know that only about a third of the citizens of our original thirteen colonies were in favor of separating from England? And your point? Were generational family members in free elections an issue, the framers would have prohibited it in the Constitution. Since there have been only TWO father son Presidents, it hasn't been an issue. There are currently 53 congressmen with family ties to political figures. http://www.usatoday.com/news/washington/2006-08-07 -relatives-list_x.htm Out of 535 members of congress, they make up just under 10%. They represent Republican and Democratic parties. Some are sons and daughters. Some are husbands and wives and brothers. If you dislike the idea of people of the same family seeking public office and being publicly elected, petition your representative to sponsor a Constitutional Amendment forbidding same family candidates. Removing wealth doesn't prevent same family candidates. Your strategy is a red herring. | ||

Doug_s |

sifo, if the earnings figures you posted are "inflation adjusted already", then they are factually incorrect. inflation is inflation. someone earning $90k back in 1975 would have to be earning $292k yust to keep up w/inflation in 2001. in 2009, it would be $355k. it ain't happening. there are reams and reams of data that show only those at the wery top of the income charts - those in the top 5% - are the only ones whose incomes over time have kept pace with inflation. everyone else - 95% - has been losing ground. so, all you suckers who are losing ground, yet still wish for "lower taxes", "less government", etc, ad nauseum, keep shooting yourselves in the foot, helping those at the top, who are taking adwantage of you, and laughing all the way to the bank. the govt is run by the rich and for the rich. socialism? ya, for the rich... and, i would never misunderstimate the desire for folks to try & make as much money as they can, regardless of the the tax rates...  doug s. | ||

Ft_bstrd |

Sifo, I don't know why German taxes may have been cut, but I suppose the 2008 global meltdown may have had something to do with it. It appears to be a recent change, judging by the link associated with that Wikipedia chart. Their version of fiscal stimulus during the crisis? In any case, Germany is an industrious, prosperous country in spite of its 2005 tax rates. Why are we to believe that the USA is worse off with its relatively lower taxes? This is the result of higher taxes: US Unemployment Rate http://www.indexmundi.com/g/g.aspx?v=74&c=us&l=en German Unemployment Rate http://www.indexmundi.com/g/g.aspx?v=74&c=gm&l=en Belgium Unemployment Rate http://www.indexmundi.com/g/g.aspx?v=74&c=be&l=en France Unemployment Rate http://www.indexmundi.com/g/g.aspx?v=74&c=hu&l=en Low tax rates? Korea http://www.indexmundi.com/g/g.aspx?v=74&c=ks&l=en New Zealand http://www.indexmundi.com/g/g.aspx?v=74&c=nz&l=en Australia http://www.indexmundi.com/g/g.aspx?v=74&c=as&l=en Switzerland http://www.indexmundi.com/g/g.aspx?v=74&c=sz&l=en Iceland http://www.indexmundi.com/g/g.aspx?v=74&c=ic&l=en | ||

Ft_bstrd |

sifo, if the earnings figures you posted are "inflation adjusted already", then they are factually incorrect. inflation is inflation. someone earning $90k back in 1975 would have to be earning $292k yust to keep up w/inflation in 2001. in 2009, it would be $355k. it ain't happening. there are reams and reams of data that show only those at the wery top of the income charts - those in the top 5% - are the only ones whose incomes over time have kept pace with inflation. everyone else - 95% - has been losing ground. so, all you suckers who are losing ground, yet still wish for "lower taxes", "less government", etc, ad nauseum, keep shooting yourselves in the foot, helping those at the top, who are taking adwantage of you, and laughing all the way to the bank. the govt is run by the rich and for the rich. socialism? ya, for the rich... and, i would never misunderstimate the desire for folks to try & make as much money as they can, regardless of the the tax rates... doug s. WTF? Please reread your above statement. You don't make no sense. Inflation adjusted means that you remove the effects of inflation in the figure in order to show real growth (or decline) in equal dollars. | ||

Sifo |

Doug_s, The numbers that I posted are what the report that you referred to was based on when you posted this...

You don't seem to have much of an understanding of any of this, and you are claiming my info is bad when my info comes from your source. See the above comments from F_B about what inflation adjusted means. I really don't know about how good the numbers are from the report you referenced, but you brought it into the discussion to make your point. I do have serious problems with the conclusions of the report you pointed to though. That's what got me looking at what data was available that they drew their conclusions from. Frankly good data or bad the report shows how a hack can play with statistics to push an agenda. Now you still hold to that agenda, but claim the data is bad? Seriously? | ||

Doug_s |

i agree w/you about one thing. you can twist the info if you like. i know what inflation adjusted means. which is exactly what the inflation calculators are. i also know that only those at the wery top are the only ones to have kept up with it. there's reams of evidence out there supporting this. the fact that even the wall street journal, a bastion of conservative economics, is now seeing it as a problem, should tell you something. here's another indicator: "...More Is Less The single-income family with two children in the early 1970s earned about $32,000 in inflation-adjusted dollars, compared to $73,000 for the dual-income family in the early 2000s. Despite the higher income, today's families save less and carry more debt: In 1970, the one-income family saved 11 percent of its take-home pay and allocated 1.4 percent of its annual income to pay revolving debt, such as credit cards. In 2005, the two-income family saved nothing, and allocated 15 percent of its annual income to revolving debt, according to Warren. In other words, the two-income family spends everything -- the second income, all of its annual savings -- and has piled on debt. Where does the money go? Despite the sticker-shock that goes with buying a gallon of milk these days, they didn't spend it on food, clothing, appliances, electronics, or automobiles -- on an inflation-adjusted basis, those costs actually went down. The Big Five Warren found two-earner families today spend three-quarters of their household incomes on five categories (which consumed only half the income of single-earner families a generation ago): Housing: The cost for families with children has risen 100 percent in inflation-adjusted dollars since 1970. Health Insurance: For a healthy family that has an employer-sponsored insurance plan, costs have risen 74 percent in inflation-adjusted dollars since 1970. In that year, the demographic group most likely to lack health insurance was a 23-year-old unmarried man with no children; today it's a person age 35 who is married with children. Cars: Families today spend 52 percent more on automobiles than in 1970, on an inflation-adjusted basis, Warren found. While the inflation-adjusted price of automobiles has dropped since 1970, families are still spending more on this category because they typically need two cars to get to work. Taxes: The first dollar that the second earner earns is taxed after the last dollar of the first earner, Warren notes. This means that the tax rate for the family unit has risen by about 25 percent between 1970 and today. Child Care: In 2007, fees in licensed centers ranged from $10,920 a year for 4-year-old children to $14,647 a year for infants, according to a study by the National Association of Child Care Resources and Referral Agencies (NACCRRA). In every region of the United States, annual costs of child care surpass the cost of food..." http://finance.yahoo.com/expert/article/moneyhappy /81176 twist the numbers if it makes you feel better thinking everyone is doing better. dig your heads deeper... and yes, "trickle up poverty" will hurt the wealthy, as the middle-class - over-worked, underpaid, and over-financed - cannot continue the uncontrolled spending that has lined the pockets of the wealthy... doug s. | ||

Brumbear |

Healthinsurance is a biggy. The Germans have health ins in there personel taxes as they have socialised med. I am not saying we need that but we need something to help cause the $804 I was spending monthly with a 20% hospital coinsurance a $5K yearly ded and no optical and dental surely makes up for the ectra personal taxes they pay and then some. But I think if we straighten the ship out and stop giving shyt away both rep and dems do it and start making shyt again we got a shot otherwise rome is falling and none of this has anything to do with h-d leaving it was poor judgenment and even worse managment plain and simple | ||

Ft_bstrd |

And yet more households have cable TV, flat screens, computers, internet, multiple smart phones, modern automobiles, the highest percentage of home ownership in history (http://www.census.gov/hhes/www/housing/census/hist oric/owner.html} Housing--artificial inflation of demand by the FEDERAL GOVERNMENT has driven housing costs higher than they normally would be. Healthcare--requirements by the FEDERAL GOVERNMENT for hospitals and clinics to provide FREE healthcare to millions of illegal immigrants has driven the costs up for those who have healthcare provided by their employers. Cars--people trade cars more frequently than ever and cars are vastly more complex than ever before. Taxes--taxes are direct and indirect. The direct taxes have been climbing for lower, middle, and upper class tax payors. Taxes are also increasing at the corporate level. The taxes at the corporate level are often folded into the prices of goods sold as a "hidden tax". Childcare--The decision to enter the work force must be measured against the price of childcare. We have been a single income household since my children were born. We could have had more money but chose to raise our own children. |