| Author | Message | ||

Aptbldr |

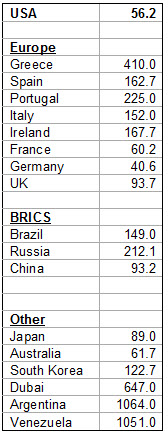

"Scores of financial and political media pundits are fond of fanning alarmist popular fears of an immanent default by the US. Many of the folks that preach this doomsday view are promoters of speculation in gold and various currency schemes that bet against the US dollar. Well, just how “unsafe” is the US, and US sovereign bonds in particular? The most direct measure can be found in the credit default spread (CDS) market. This represents the price set in the marketplace for the cost of insuring against a default. Below is a current list of the cost of sovereign default insurance premiums.  By this reckoning, the risk of a sovereign default by the US is amongst the lowest in the world. The risk of default by the US is considered to be substantially lower than all European countries with the exception of Germany. The risk of US default is deemed substantially lower than Japan or South Korea. The risk of US sovereign default is deemed substantially lower than any of the BRICS, including current darling China. ..." - James Kostohryz | ||

Mr_grumpy |

I keep an eye on various currencies, for shopping purposes y'unnerstan, & I've noticed the Dollar has pulled up about 8-10 cents against the Euro in the last couple of weeks. Interesting figures in the table with France running a close 3rd behind the US & UK behind China. I've no idea how the figures are worked out though so can't comment on their validity. As usual a thing's worth what somebody will pay for it & with currencies it's mostly a matter of confidence that determines the price. |